Ability of lawyer, living will, rely on, and healthcare directive paperwork are the most typical estate organizing instruments, but it really’s also essential to think about gifting and money preparing for heirs.

We delight in dealing with high net well worth and ultra-higher net really worth investors and family members who want what we simply call monetary serenity – the feeling that arrives any time you know your funds and the lifestyle you desire are actually secured for life, and that you don’t have to do any with the work to deal with and preserve it simply because you hired a reliable advisor to take care of every thing.

By clicking “Take All Cookies”, you conform to the storing of cookies on your product to boost web page navigation, evaluate internet site utilization, and guide within our promoting initiatives.

Portfolio resilience is a simple notion, but delivering on its assure demands a thoughtful technique.

” He warns that seemingly good investments can modify after some time Which markets are subject to long-phrase fluctuations.

Although the U.S. govt no longer mints the silver bucks that it once backed, mints all around the globe build silver cash which have been employed for financial investment uses. The American Silver Eagle along with the Canadian Silver Maple Leaf series serve as specifically preferred examples.

Diversifying investments is an important A part of wealth preservation as it decreases possibility. A diversified portfolio spreads the wealth and threat across unique asset classes, Therefore if a number of investments encounter a loss, the Other people remain safe.

A loved ones Place of work model can benefit extremely-higher-Internet-truly worth families wanting to diversify their asset management techniques. On this scenario, an objective household Business office adviser coordinates and manages the loved ones's interactions with different advisers.

PillarWM Web site works by using privateness policy and phrases of support for making your on the web experience a lot easier and much better.

As equity markets have moved lower in latest months, mostly on investor fears about tariffs, a lot of our shoppers are progressively searching for downside possibility mitigation, optimized income and support staying invested in unsure periods. All three strategies can strengthen portfolio resilience.

Making certain wealth transitions easily throughout generations requires thorough planning to lessen legal complications, tax burdens, and prospective disputes. Trusts assistance manage asset transfers when sustaining Management about how and when beneficiaries acquire their inheritance. As opposed to wills, which experience probate—a public and often lengthy lawful procedure—trusts enable assets to pass directly to heirs, preserving privateness and cutting down administrative delays. Revocable dwelling trusts offer flexibility, letting the grantor to switch or dissolve the have confidence in during their life time though avoiding probate on More Bonuses death. On the other hand, they don't supply security from creditors or estate taxes. Irrevocable trusts, However, clear away assets in the grantor’s taxable estate, shielding them from creditors and minimizing estate tax publicity.

The AccountingInsights Crew is often a remarkably experienced and assorted assembly of accountants, auditors and finance administrators. Leveraging a long time of a knockout post encounter, they supply useful assistance to assist you far better recognize advanced money and accounting ideas.

As a result, the ultra-rich should consider various factors whilst looking for somebody to assist with wealth preservation, A charge-primarily based wealth advisory design is aligned using this type of custodian check out.

At Pillar Wealth Administration, we have an understanding of the value of productive asset allocation and ended up satisfied to debate the intricate aspects along with you. Simply click here to program a cost-free consultation and see how we are able to acquire the ideal asset allocation approach in your case.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Haley Joel Osment Then & Now!

Haley Joel Osment Then & Now! Elisabeth Shue Then & Now!

Elisabeth Shue Then & Now! Daryl Hannah Then & Now!

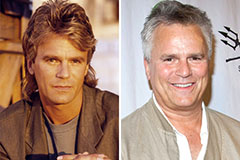

Daryl Hannah Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!